By Guest Blogger George Elliott, Banc Home Loans

Being a loan officer, the most common question I am asked is “What is the rate today” and “Where do I see them going?” The first question is easy — all I have to do is look on a computer screen and let them know what I see. The second question, as you can imagine, is much more difficult, and if I knew for sure what the rates would do in the coming weeks, months and years, I would not be a loan officer anymore. I would be living in a castle on a tropical island.

Being a loan officer, the most common question I am asked is “What is the rate today” and “Where do I see them going?” The first question is easy — all I have to do is look on a computer screen and let them know what I see. The second question, as you can imagine, is much more difficult, and if I knew for sure what the rates would do in the coming weeks, months and years, I would not be a loan officer anymore. I would be living in a castle on a tropical island.

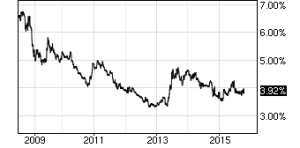

Opinions are like cell phones, almost everybody has one. What we can do is look at the facts. The Federal Reserve has been hinting for some time that they will be raising the Fed funds rate. Will that translate to higher mortgage rates — we all know with time it will, but how much time? We also assume if history is any guide, the Fed will not do too much more in 2016. Why? In an election year the Fed does not like to make major moves that could affect the economy to favor or punish any political party before the election.

There are of course many other factors that can have an effect on mortgage rates, but most agree the rates will remain low through 2016 but beyond that… grab a crystal ball. After 23 years in this business, I advise potential borrowers to grab a rate based on the known rather than gamble with the unknown.

Unless they have a crystal ball.

George Elliott is a senior loan officer at Banc Home loans in Petaluma CA.

George Elliott is a senior loan officer at Banc Home loans in Petaluma CA.

George has 23 years’ experience in mortgage lending and has been recognized

as a Presidents club member for the past 17 years.

He can be reached at George.Elliott[at]banchomeloans.

Recent Comments